One topic that has come up consistently in my 40+ years of reading and thinking about energy is the notion that the world is running out of fossil fuels. The reality, as best I can tell, is that this is not true on any near-term timescale. Fossil fuels are finite and we are using them faster than nature can replace them, but much remains to be found and utilized if people wish. The concerns stimulated by H. King Hubbert in 1956, when he proposed his theory on oil well production and depletion and published the ‘Hubbert Curve’ (see below) are valid for some assumptions but ignore other realities that make his conclusions, and those of others who have accepted his theory, invalid for long-term planning. I will explain why I believe this in the discussion that follows, recognizing that part of the discussion turns on a definition of what is meant by Peak Oil.

A 1956 world oil production distribution, showing historical data and future production, proposed by M. King Hubbert; it has a peak of 12.5 billion barrels per year about the year 2000

Hubbert’s Peak Theory is based on the obvious fact that the utilization of a finite resource must go through an initial start-up, reach a peak level of production, and eventually tail off as the resource is depleted. This is common sense, applicable to all non-renewable resources, and not disputable. What is disputable is the shape of the production/depletion curve and the assumptions that went into identifying the resource to be utilized and eventually depleted. Much of the public discussion that has ensued about Peak Oil, the application of Hubbert’s theory to oil (petroleum) extraction, since publication of Hubbert’s 1956 paper has revolved about these two facets of his theory.

It is important to clarify up front that Peak Oil is the point in time when oil extraction reaches its maximum rate and is not synonymous with oil depletion. Following a peak in extraction rate about half of the resource is still available for extraction, and production rate decreases steadily thereafter. Much discussion has focused on the shape of the declining curve after Peak Oil is reached – plateau? sharp decline? slow decline? – and the implications for the U.S. and world economies that are so dependent on oil supplies.

Hubbert’s theory received great visibility when he correctly predicted, in his 1956 paper, that U.S. domestic oil production would peak between 1965 and 1971. He used the terms ‘peak production rate’ and ‘peak in the rate of discoveries’; the term Peak Oil was introduced in 2002 by Colin Campbell and Kjelll Aleklett when they formed ASPO, the Association for the study of Peak Oil & Gas.

Where the application of Hubbert’s theory has failed (I don’t blame him) is in the boundary conditions (assumptions) on which his theory is based. He did not anticipate, nor did others, the rapid emergence of unconventional oil and the substitutions for oil (alternative fuels, electrification of transportation) that have been or are being developed. He did mention these possibilities and did his best with the information available at the time; I cannot say that about modern Peak Oil theorists who still put out stories intended to scare.

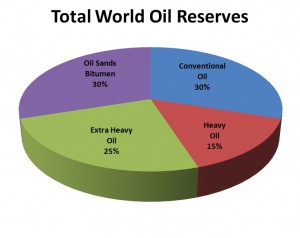

What has changed is that oil production no longer depends only on ‘conventional’ oil supplies but increasingly on ‘unconventional’ resources that are an increasing part of total oil supply. A few definitions, courtesy of Wikipedia, will help:

“Conventional oil is oil that is generally easy to recover, in contrast to oil sands, oil shale, heavy crude oil, deep-water oil, polar oil and gas condensate. Conventional oil reserves are extracted using their inherent pressure, pumps, flooding or injection of water or gas. Approximately 95% of all oil production comes from conventional oil reserves.

Unconventional oil is oil that is technically more difficult to extract and more expensive to recover. The term unconventional refers not only to the geological formation and characteristics of the deposits but also to the technical realisation of ecologically acceptable and economical usage.”

Given these definitions, we can probably all agree that the age of cheap oil is over, as reflected in the following graph of historical oil prices:

As reported by former BP geologist Dr. Richard Miller in a speech at University College of London in 2013: “..official data from the International Energy Agency, the US Energy Information Administration, the International Monetary Fund, and other sources, showed that conventional oil had most likely peaked around 2008.” He further pointed out that “peaking is the result of declining production rates, not declining reserves”, that many oil producing countries are already post-peak, and that conventional oil production has been flat since about the middle of the past decade. There has been growth in liquid supply since then, largely due to natural gas liquids and oil derived from oil sands. Reserves have also been growing due to new discoveries, improved oil field extraction technology, and increasing reliance on unconventional resources.

The debate about Peak Oil has been underway for quite a few decades, many words have been spoken and much ink has been used to illuminate and document that debate, and Peak Oil still has its adherents. One of my purposes in exploring this subject for my blog was to review the latest literature and form an updated opinion. I have – Peak Oil is not real if you take into account the full liquid fuels situation. In fact, in the course of my research I have come across several opinions that I fully agree with and share them with you as my summation of this post.

(Wikipedia)”In 2009, Dr. Christoph Rühl, chief economist of BP, argued against the peak oil hypothesis:

Physical peak oil, which I have no reason to accept as a valid statement either on theoretical, scientific or ideological grounds, would be insensitive to prices. (…) In fact the whole hypothesis of peak oil – which is that there is a certain amount of oil in the ground, consumed at a certain rate, and then it’s finished – does not react to anything…. Therefore there will never be a moment when the world runs out of oil because there will always be a price at which the last drop of oil can clear the market. And you can turn anything into oil into if you are willing to pay the financial and environmental price… Global Warming is likely to be more of a natural limit than all these peak oil theories combined. (…) Peak oil has been predicted for 150 years. It has never happened, and it will stay this way.

According to Rühl, the main limitations for oil availability are “above ground” and are to be found in the availability of staff, expertise, technology, investment security, money and last but not least in global warming. The oil question is about price and not the basic availability. Rühl’s views are shared by Daniel Yergin of CERA, who added that the recent high price phase might add to a future demise of the oil industry, not of complete exhaustion of resources or an apocalyptic shock but the timely and smooth setup of alternatives.”

One other opinion I agree with, by George Monbiot, writing in the guardian on 2 July 2012 (‘We were wrong on peak oil. There’s enough to fry us all’): “Some of us made vague predictions, others were more specific. In all cases we were wrong. In 1975 MK Hubbert, a geoscientist working for Shell who had correctly predicted the decline in US oil production, suggested that global supplies could peak in 1995. In 1997 the petroleum geologist Colin Campbell estimated that it would happen before 2010. In 2003 the geophysicist Kenneth Deffeyes said he was “99% confident” that peak oil would occur in 2004. In 2004, the Texas tycoon T Boone Pickens predicted that “never again will we pump more than 82m barrels” per day of liquid fuels. (Average daily supply in May 2012 was 91m.) In 2005 the investment banker Matthew Simmons maintained that “Saudi Arabia … cannot materially grow its oil production”. (Since then its output has risen from 9m barrels a day to 10m, and it has another 1.5m in spare capacity.)

Peak oil hasn’t happened, and it’s unlikely to happen for a very long time.”

Enough said!